Imagine you are an e-commerce entrepreneur running your online store with dreams of success and profitability.

Every decision you make, and every strategy you implement, is driven by one ultimate goal: maximizing your profit margins. But to achieve this goal, you need to understand a critical concept at your business’s core: Cost of Goods Sold (COGS).

COGS is more than just a financial term; it’s the key to unlocking the secrets of profitability in the e-commerce industry. By grasping the ins and outs of COGS, you can gain valuable insights into your business’s financial health, make informed pricing decisions, and identify areas for cost optimization.

In this article, we’ll define the term costs of goods sold, formulas to calculate COGS, the importance of knowing COGS and choosing a method for COGS.

Let’s get started.

What is Cost Of Goods Sold?

Cost of Goods Sold (COGS) is a fundamental financial metric used to calculate the direct expenses associated with producing or acquiring goods that a company sells.

It represents the costs directly incurred in creating or obtaining the products that are subsequently sold to customers. By understanding and effectively managing COGS, e-commerce entrepreneurs can gain valuable insights into their operational efficiency, pricing strategies, and overall profitability.

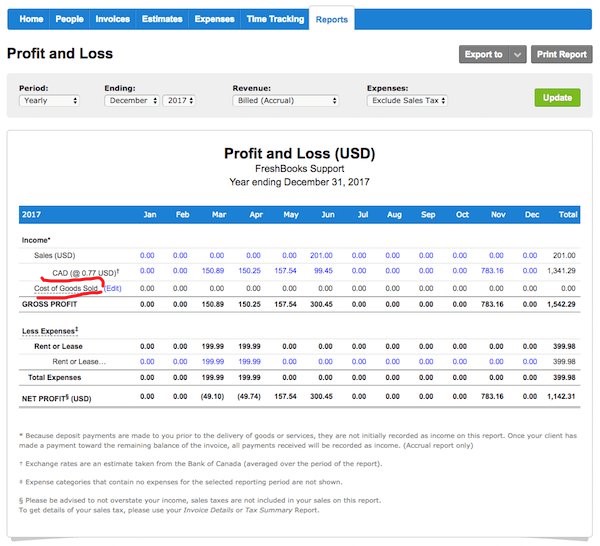

COGS is usually found on an income statement directly beneath “sales” or “income.” An income statement is also called a “profit and loss statement.” Here’s an example:

COGS is particularly relevant to businesses involved in producing, manufacturing, or distributing physical goods. Whether you run a small-scale e-commerce store, a boutique business, or a large-scale enterprise, COGS is a crucial component in evaluating your operations’ financial health and performance.

It enables entrepreneurs to determine the true cost of each unit sold, providing a foundation for informed decision-making in areas such as pricing, inventory management, and product development.

For e-commerce businesses, COGS encompasses various expenses directly tied to creating or procuring products. These costs typically include the raw materials used in manufacturing, packaging materials, direct labor expenses, shipping and freight charges, and other expenses directly associated with the production process.

Understanding and accurately tracking these costs enable entrepreneurs to evaluate the profitability of their products and make strategic adjustments to optimize their operations.

How To Calculate Cost OF Goods Sold?

Calculating the Cost of Goods Sold (COGS) is crucial to accurately determine the expenses directly associated with the products sold.

Let’s explore the basic and extended formulas for calculating COGS, along with their individual components.

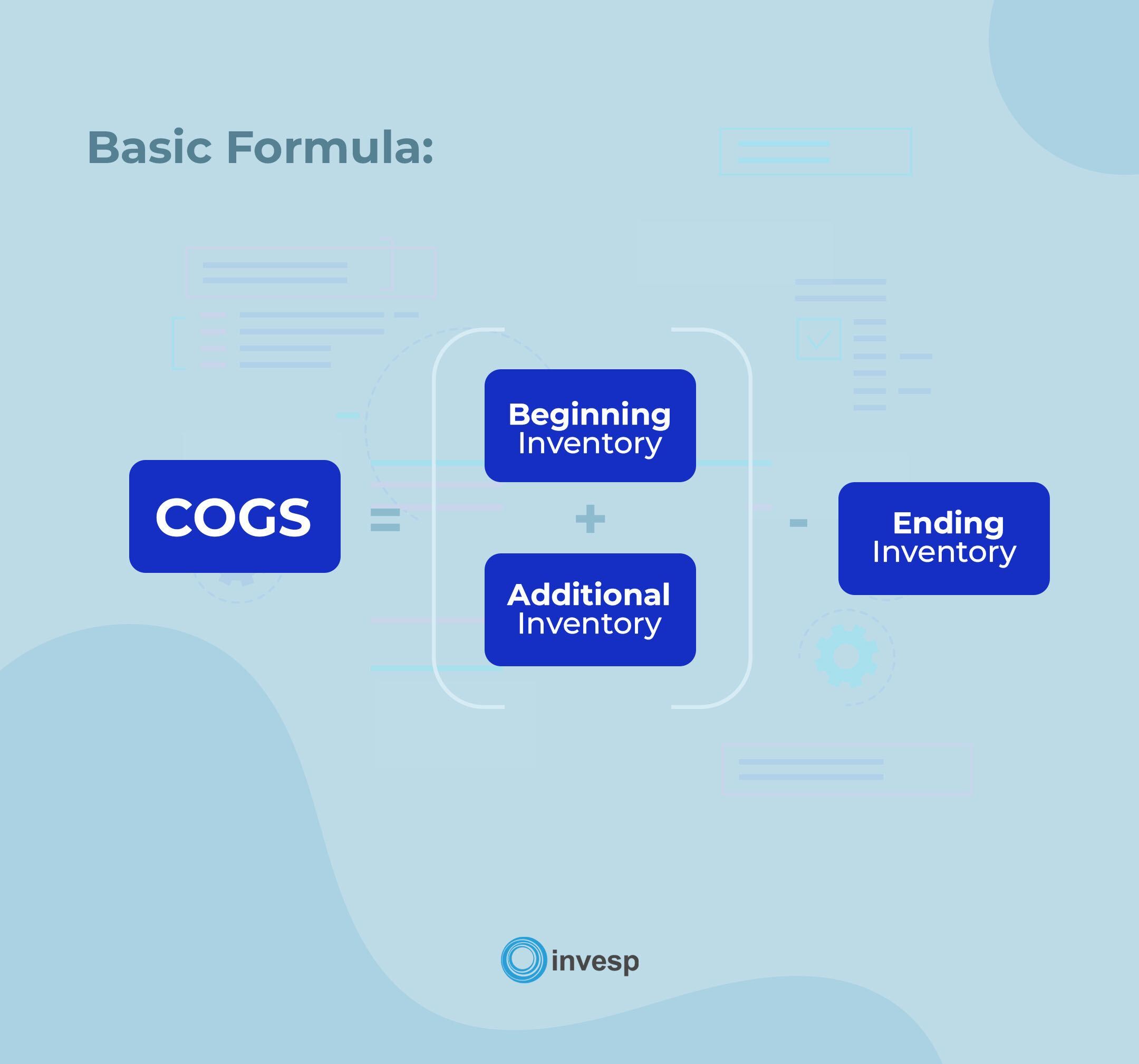

Basic Formula:

The basic formula for calculating COGS is as follows: COGS = (Beginning Inventory + Additional Inventory) – Ending Inventory.

- Beginning Inventory: This represents the inventory value at the beginning of a specific accounting period, such as a month or year. It includes the cost of goods that were already in stock from the previous period.

- Additional Inventory: This refers to the value of inventory purchased or produced during the accounting period being considered. It includes the cost of new stock that is acquired to replenish or expand the inventory.

- Ending Inventory: This represents the inventory value remaining at the accounting period’s end. It includes the cost of goods not sold and still in stock.

Example 1:

Let’s say an e-commerce entrepreneur starts the year with $20,000 worth of inventory (beginning inventory). Throughout the year, they purchase an additional $50,000 worth of inventory.

At the end of the year, their remaining inventory is valued at $15,000 (ending inventory).

Using the basic formula, the COGS can be calculated as follows:

COGS = ($20,000 + $50,000) – $15,000 COGS = $70,000 – $15,000 COGS = $55,000

This means that the cost of goods sold during the year amounted to $55,000.

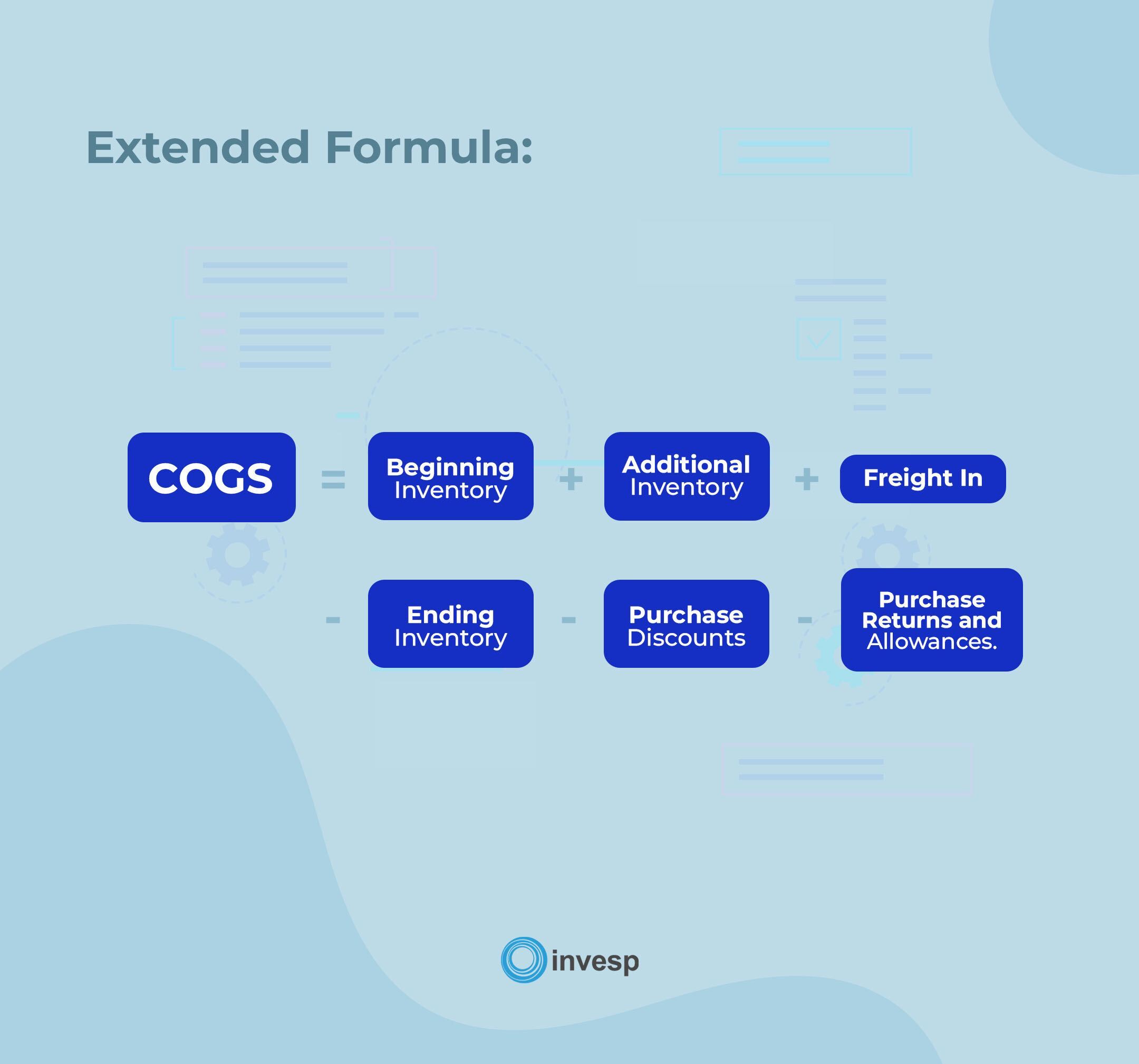

Extended Formula:

The extended formula for calculating COGS provides a more comprehensive view by considering additional factors. It is as follows:

COGS = Beginning Inventory + Purchases + Freight In – Ending Inventory – Purchase Discounts – Purchase Returns and Allowances.

- Purchases: This includes the cost of additional inventory purchased during the accounting period, similar to the “additional inventory” component in the basic formula.

- Freight In: This represents the freight or shipping charges incurred when bringing the inventory into the business. It includes transportation costs from suppliers to the business’s location.

- Purchase Discounts: This refers to any discounts received for early payment or volume purchases, reducing inventory costs.

- Purchase Returns and Allowances: This accounts for any returned inventory or allowances granted by suppliers, reducing inventory cost.

Example 2:

Suppose an e-commerce entrepreneur begins the month with $15,000 worth of inventory (beginning inventory).

Throughout the month, they make purchases totaling $25,000. The freight charges associated with these purchases amount to $2,000 (freight in). At the end of the month, the remaining inventory is valued at $12,000 (ending inventory).

Additionally, the entrepreneur received a $500 purchase discount during the month.

Using the extended formula, the COGS can be calculated as follows:

COGS = $15,000 + $25,000 + $2,000 – $12,000 – $500 COGS = $30,500

This means that the cost of goods sold for the month equals $30,500.

By employing the appropriate formula and considering all the relevant components, e-commerce entrepreneurs can accurately calculate their COGS, gaining valuable insights into the direct expenses associated with their inventory.

This information serves as a foundation for effective pricing strategies, inventory management, and overall financial analysis.

Importance Of Knowing COGS

Understanding the Cost of Goods Sold (COGS) is essential, as it provides valuable insights that can positively impact various aspects of eCommerce business operations.

Let’s explore the importance of knowing COGS in detail.

1. Helps You Set the Right Product Price:

Knowing the COGS enables you to set appropriate product prices, directly affecting market profitability and competitiveness.

By accurately calculating the costs associated with producing or acquiring goods, you can determine the minimum price you need to charge to cover expenses and generate a reasonable profit margin.

Setting prices too low can lead to losses, while setting them too high may deter customers.

Knowledge of COGS empowers entrepreneurs to strike a balance that attracts customers, maximizes profits, and maintains competitiveness in the market.

2. Helps You Manage Your Taxes:

COGS plays a vital role in tax management.

In many jurisdictions, taxes are calculated based on net profit, and COGS is a crucial component in determining the net profit of a business.

By accurately tracking and documenting COGS, you can reduce your tax liabilities by deducting the direct costs associated with their products from their revenues.

This knowledge helps you optimize your tax planning strategies, minimize tax burdens, and ensure compliance with tax regulations.

3. Helps You Analyze Your Business Health:

Knowing the COGS allows you to analyze the overall health of your business. By comparing COGS to the revenue generated, the gross profit margin can be determined, which provides insights into the efficiency and profitability of business operations.

Monitoring the trend of COGS over time helps you identify cost fluctuations, assess the impact of pricing changes, and make informed decisions to optimize their cost structures.

Understanding the relationship between COGS and revenue facilitates financial analysis, performance evaluation, and strategic planning.

4. Helps You Detect Growth Opportunities:

COGS provides valuable information for identifying growth opportunities within an e-commerce business.

By analyzing the profitability of individual products or product categories based on their respective COGS, you can identify high-margin products and focus on expanding those segments.

Additionally, understanding the COGS associated with different channels, customer segments, or geographic regions allows you to identify potential growth areas and allocate resources strategically.

This knowledge enables you to capitalize on opportunities for business expansion.

5. Helps Optimize Direct and Indirect Costs:

Knowing the COGS enables you to optimize direct and indirect costs associated with operations.

By analyzing the components of COGS, such as raw material costs, packaging expenses, and shipping charges, you can identify areas where cost-saving measures can be implemented.

This knowledge helps streamline procurement processes, negotiate favorable terms with suppliers, eliminate wasteful practices, and enhance overall operational efficiency.

By optimizing direct and indirect costs, you can improve profit margins, reinvest in the business, or pass on the benefits to customers through competitive pricing.

6. Helps You Determine Net Profit:

COGS is a key factor in determining the net profit of an e-commerce business. By deducting the COGS from the revenue generated, you can calculate the gross profit of your business.

This figure represents the remaining amount after accounting for the direct costs of the products sold. From the gross profit, you can further deduct operating expenses, taxes, and other costs to arrive at the net profit.

Understanding the relationship between COGS and net profit helps you evaluate the financial performance of your business, make informed decisions, and develop strategies to improve profitability.

Choosing a Costing Method for COGS

When calculating the Cost of Goods Sold (COGS), there are several costing methods to choose from.

Each method has advantages and disadvantages, and the selection depends on the specific needs and characteristics of the business.

Let’s explore four commonly used costing methods: FIFO, LIFO, MAC, and Specific Identification.

1. FIFO (First-In, First-Out)

FIFO is a costing method where the first inventory items purchased or produced are considered the first ones sold.

This method assumes that the oldest inventory is sold first while the most recent inventory remains in stock.

The advantages of FIFO include:

- Reflects the natural flow of inventory and is intuitive to understand.

- Generally results in a more accurate representation of the current value of inventory.

- Minimizes the risk of inventory obsolescence as older inventory is sold first.

However, FIFO also has disadvantages:

- During periods of inflation, it may result in higher net income and taxes paid, as the cost of older inventory is lower than the replacement cost.

- It may not accurately reflect the actual physical flow of goods in certain industries or situations.

2. LIFO (Last-In, First-Out)

LIFO is a costing method where the most recent inventory items purchased or produced are considered the first ones sold.

This method assumes that the newest inventory is sold first while the oldest inventory remains in stock.

The advantages of LIFO include:

- Reflects the impact of inflation by matching the higher current replacement costs with revenue.

- It can result in lower taxable income during periods of inflation.

However, LIFO also has disadvantages:

- It does not reflect the actual flow of inventory, which may be a concern for certain industries.

- This may lead to inaccurate inventory valuation during periods of deflation.

- It can create complications when tracking and managing inventory if not done meticulously.

3. MAC (Moving Average Cost)

MAC is a costing method where the average cost of all units in inventory is calculated and applied to the cost of goods sold.

The advantages of MAC include:

- Smooths out fluctuations in inventory cost by considering the average cost of all units.

- Provides a more balanced and stable representation of the cost of goods sold.

- Minimizes the impact of price fluctuations in the market.

However, MAC also has disadvantages:

- It may not accurately reflect the current replacement cost of inventory.

- It can result in higher net income during periods of inflation compared to FIFO, as older, lower-cost inventory is not fully reflected.

4. Specific Identification:

Specific Identification is a costing method commonly used in industries where each item can be identified and assigned a specific cost.

This method involves tracking the cost of each item sold separately.

The advantages of Specific Identification include:

- Provides the most accurate valuation of COGS as it matches the actual cost of each item sold.

- Ideal for industries with unique or high-value items, such as luxury goods or customized products.

However, Specific Identification also has disadvantages:

- Requires meticulous record-keeping and tracking of individual inventory items, which can be time-consuming and complex.

- It may not be practical for industries with many low-value items or rapidly changing inventory.

Considering the advantages and disadvantages of these costing methods, the MAC (Moving Average Cost) method often emerges as the preferred option for many e-commerce businesses.

MAC balances accuracy and simplicity, making it the best of both worlds.

It smooths out cost fluctuations, provides a comprehensive picture of costs, and is easy to implement and manage.

Moreover, averaging costs allows entrepreneurs to maintain consistent COGS, reducing the impact of market fluctuations and providing a more stable financial picture.

Interpreting Your Business COGS

The Cost of Goods Sold (COGS) plays a crucial role in interpreting and analyzing the operational efficiency of an e-commerce business.

Here are some ways it can help:

1. Determining Operational Efficiency:

COGS serves as a key metric for evaluating the operational efficiency of a business. By analyzing COGS in relation to revenue, you can calculate the gross profit margin, which indicates the percentage of revenue retained after accounting for direct production costs.

A higher gross profit margin suggests a more efficient operation, as a larger portion of revenue is available to cover indirect costs and generate net profit.

Monitoring the trend of COGS over time allows you to assess the efficiency of their production processes, identify cost-saving opportunities, and make data-driven decisions to improve operational efficiency.

2. Reducing Operational Costs:

COGS analysis provides valuable insights into areas where operational costs can be reduced.

By identifying the components of COGS, such as labor costs, machine idle time, or other production expenses, you can implement strategies to minimize these costs.

For example, you can lower production costs and improve overall efficiency by optimizing staffing levels, streamlining production processes, or leveraging technology to reduce machine idle time.

Furthermore, COGS analysis enables business owners to identify and implement new business tactics, such as sourcing materials from more cost-effective suppliers or renegotiating contracts, to reduce expenses and enhance profitability.

3. Minimizing Theft and Product Damage

COGS analysis can help you address challenges related to theft and product damage, which can significantly impact profitability.

By monitoring COGS and comparing it to sales revenue, you can identify any discrepancies that may indicate losses due to theft or damage.

With this information, you can implement appropriate security measures, such as surveillance systems, inventory control procedures, or employee training programs, to minimize theft risks and safeguard your products.

Additionally, by understanding the financial impact of product damage through COGS analysis, you can prioritize investments in quality control, packaging improvements, or shipping methods that reduce the likelihood of product damage and associated costs.

4. Avoiding Overstocking and Last-Minute Orders:

COGS analysis can help you strike a balance between stocking enough inventory to meet customer demand and avoiding excessive inventory levels that result in increased warehousing and storage costs.

You can optimize inventory management practices by understanding the relationship between COGS and inventory turnover.

Overstocking leads to higher carrying costs, potential product obsolescence, and increased risk of losses.

Conversely, insufficient stock levels can result in last-minute rush orders, increased shipping costs, and potential loss of revenue due to unfulfilled customer demands.

COGS analysis provides you with insights into inventory levels, enabling you to make informed decisions on procurement, sales forecasting, and inventory optimization to achieve better operational efficiency and cost control.

Tips for Improving Operational Efficiency Based on COGS Analysis

1. Optimize Supply Chain Management:

Analyze the components of COGS related to the procurement and transportation of goods. Look for opportunities to optimize your supply chain, such as negotiating better terms with suppliers, consolidating shipments to reduce transportation costs, or implementing just-in-time inventory management to minimize carrying costs.

2. Streamline Production Processes:

Examine the specific production costs within COGS and identify areas where processes can be streamlined. Look for ways to reduce waste, improve workflow, or automate repetitive tasks. Implement lean manufacturing principles or invest in technology solutions that enhance efficiency and reduce production costs.

3. Implement Quality Control Measures:

Review COGS related to product defects, returns, or customer complaints. Implement robust quality control measures to minimize the occurrence of defects and ensure that products meet customer expectations. This helps reduce the costs associated with rework, returns, and customer dissatisfaction.

4. Analyze Pricing Strategies:

Utilize COGS analysis to evaluate the profitability of different products or product categories. Identify low-margin or high-cost items and assess whether adjustments in pricing or sourcing can be made to improve profitability. Consider strategies such as value engineering, product bundling, or negotiating better pricing with suppliers to enhance margins.

5. Optimize Inventory Management:

Leverage COGS analysis to fine-tune your inventory management practices. Use data on inventory turnover, carrying costs, and demand patterns to optimize reorder points, safety stock levels, and lead times. Implement inventory management systems or software to automate and streamline the process, reducing costs associated with overstocking or stockouts.

6. Invest in Employee Training and Development:

Examine labor costs within COGS and identify opportunities to enhance employee productivity and skills. Provide training programs focusing on improving efficiency, time management, and job-specific skills. Engage employees in continuous improvement initiatives and empower them to contribute ideas for process optimization and cost reduction.

7. Monitor and Control Overhead Costs:

While COGS primarily focuses on direct costs, overhead costs also impact overall operational efficiency. Analyze and monitor expenses such as rent, utilities, administrative costs, and marketing expenditures. Identify areas where cost-saving measures can be implemented without compromising business operations or customer experience.

COGS Metrics And Ratios You Should Know

Three key metrics and ratios are related to the Cost of Goods Sold (COGS).

Let’s explore them and see what they mean for any eCommerce business.

1. COGS Ratio:

The COGS ratio measures the proportion of a company’s revenue that is consumed by the Cost of Goods Sold.

It is calculated by dividing COGS by total revenue and multiplying the result by 100 to express it as a percentage.

The formula for the COGS ratio is:

COGS Ratio = (COGS / Total Revenue) * 100

The COGS ratio signifies the efficiency of the business’s cost management and production processes.

A higher COGS ratio indicates that a larger portion of revenue is used to cover the costs directly associated with producing or purchasing goods.

This may suggest that the business has higher production costs, inefficient inventory management, or pricing strategies that impact profitability.

On the other hand, a lower COGS ratio implies greater cost efficiency and improved profitability.

Analyzing the COGS ratio helps business owners identify trends and make informed decisions regarding pricing strategies, sourcing alternatives, or process optimization to better balance revenue and costs.

2. Inventory Turnover:

Inventory turnover is a metric that measures how efficiently a business manages its inventory by evaluating the number of times inventory is sold and replaced within a given period.

It is calculated by dividing the COGS by the average inventory value.

The formula for inventory turnover is:

Inventory Turnover = COGS / Average Inventory

The inventory turnover signifies the speed at which inventory is converted into sales and replenished.

A high inventory turnover suggests that goods are sold quickly, minimizing the carrying costs associated with inventory.

It reflects efficient inventory management, effective sales strategies, and accurate demand forecasting.

Conversely, a low inventory turnover indicates slower sales or excess inventory, potentially leading to increased carrying costs, obsolescence, or the risk of losses due to product deterioration.

By monitoring inventory turnover, e-commerce entrepreneurs can optimize their inventory levels, improve cash flow, reduce storage costs, and ensure the availability of the right products at the right time.

3. Gross Profit Margin:

The gross profit margin measures the profitability of a business’s core operations after deducting the Cost of Goods Sold from revenue.

It represents the percentage of revenue that remains after accounting for the direct costs associated with producing or purchasing goods.

The formula for the gross profit margin is:

Gross Profit Margin = (Total Revenue – COGS) / Total Revenue) * 100

The gross profit margin signifies the efficiency of a business in generating profits from its core operations.

A higher gross profit margin indicates better profitability and the ability to cover indirect expenses, such as marketing, administration, and overhead costs.

It reflects the business’s pricing strategy, cost control, and competitive positioning. Conversely, a lower gross profit margin suggests higher production costs or pricing pressures, which may require sourcing, pricing, or cost management adjustments.

Analyzing the gross profit margin enables entrepreneurs to assess the profitability of their products or services, identify opportunities for cost reduction, and evaluate the effectiveness of their pricing strategies.

Final Thoughts

As I said in the introduction, COGS is the key to unlocking profitability for any eCommerce business.

And to achieve that, this article has shown you how to calculate the COGS formula (basic and extended), direct costs incurred, COGS ratio, and other important metrics.

If you apply all that you read here, you should be able to interpret your business COGS, see profitability and plug all leaks and damages in your business revenue.