Ever wondered why your marketing budget keeps growing, but your profits aren’t catching up? The issue might be that you’re focusing more on acquiring new customers than keeping the ones you already have.

Here’s the thing—acquiring new customers is necessary for growth, but keeping your existing ones is much cheaper and more effective in the long run.

So, how do you strike the balance? By understanding the real costs behind customer acquisition and retention and taking action.

Discover the latest statistics and trends related to customer acquisition vs. retention costs across industries and the reasons behind them. This article also discusses the formulas for calculating acquisition and retention costs.

What Is Customer Acquisition vs Retention

Customer acquisition is all about attracting and converting new people into paying customers. This can involve various tactics, from digital marketing campaigns and social media outreach to events, email marketing, and more.

It involves introducing your product or service to someone who has never bought from you and persuading them to make that first purchase.

You can calculate CAC (customer acquisition cost) using a simple formula:

CAC = (Cost of sales + cost of marketing) ÷ Number of new customers.

Here are the key factors that influence customer acquisition strategy:

- Marketing efforts: The effectiveness of your ads, content, and messaging

- Sales processes: How well your team can engage and convert leads

- Brand awareness: The visibility and reputation of your business in the market

- Product-market fit: How well your product meets the needs of your target audience

On the other hand, customer retention strategies are all about keeping existing customers happy and ensuring they stay after their first purchase.

How will you calculate customer retention costs? Here’s a simple formula:

Customer Retention Cost = Total Retention Cost / Number of Active Customers

It’s not just about keeping them satisfied—it’s about building loyalty so they come back again and again. Retention efforts usually focus on maintaining solid relationships with your customers, providing them with value beyond the initial sale, and making sure their experience with your brand keeps improving.

Here are the key factors that influencer customer retention:

- Customer satisfaction: How well your product or service meets their ongoing needs

- Support and service: The quality of your customer support, response time, and problem-solving abilities

- Personalization: Tailoring your communication, offers, and interactions to individual customer preferences

- Loyalty programs: Incentives that reward repeat business, such as discounts, perks, or exclusive deals

Customer Acquisition Costs (CAC) – Key Statistics

Here are some key customer acquisition cost statistics every business owner should be aware of:

Average CAC by Industry

As of 2024, the average Customer Acquisition Cost (CAC) varies significantly across eCommerce sectors. Here are some key statistics:

These figures are derived from proprietary data collected from over 80 clients between 2017 and 2023, highlighting the importance of understanding industry benchmarks for effective marketing strategies.

Evolution of CAC Over Recent Years

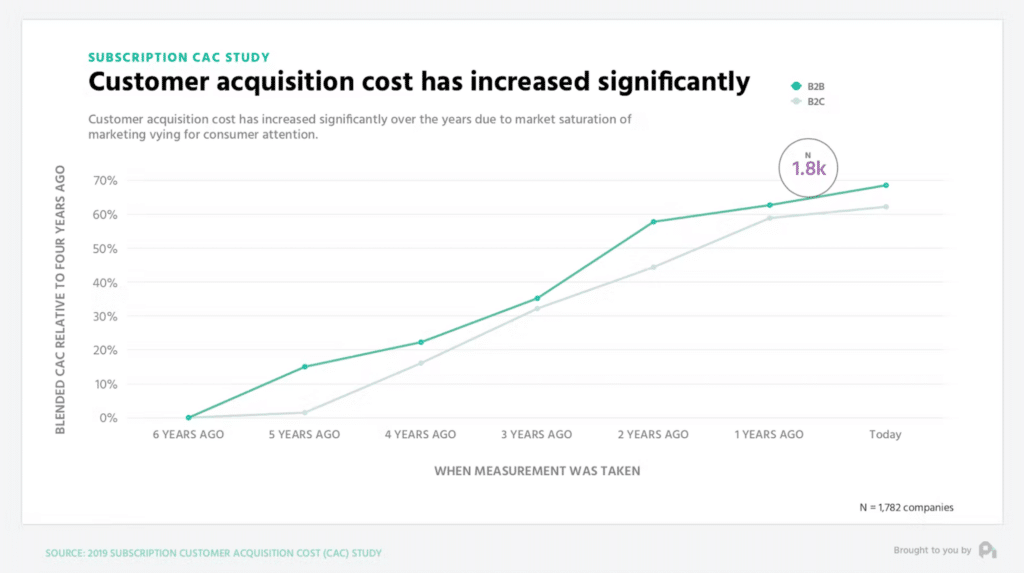

- Rising customer acquisition costs: a 60-75% surge from 2014 to 2019

The trend in CAC has shown a significant increase in recent years. From 2014 to 2019, CAC rose by approximately 60-75% for both B2C and B2B businesses, driven by heightened competition and increased advertising costs. (Source)

More recently, a study indicated a 50% increase in average CAC for digital businesses over five years, emphasizing the escalating challenges faced in customer acquisition due to factors such as increased competition and rising ad costs on platforms like Facebook and Google.

- E-commerce focus: customer acquisition costs surge by 60% in five years

According to data from the e-commerce optimization platform SimplicityDX, customer acquisition costs (CAC) have skyrocketed by 60% over the last five years, reaching 2024. (Source)

This significant increase shows the growing challenge for online businesses trying to attract new customers in an increasingly crowded market.

What’s the reason behind this gradual spike in customer acquisition costs?

This surge could be due to the rising competition across many industries.

More companies are trying to attract the same customers, which means everyone is spending more on advertising to grab attention. As companies increase their bids for online ads, the costs increase, making reaching potential customers more expensive.

Another reason behind this increase in the CAC could be the perennially changing algorithms and policies of companies like Google and Facebook. To keep up with the changing trends, businesses often invest more to achieve the same visibility and engagement they once enjoyed.

Customer Retention Costs – Key Statistics

Average Retention Costs by Industry

Customer Retention Rates Vary Widely Like customer acquisition costs, Customer Retention Costs (CRC) vary across industries. It all depends on the time, resources, and efforts you invest in customer service, loyalty programs, and marketing to retain existing customers.

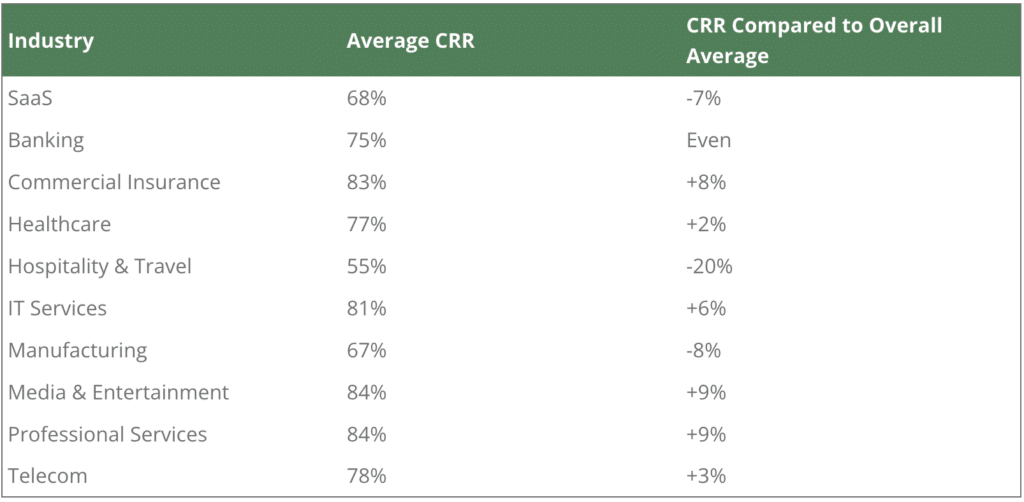

When we look at customer retention rates across different industries, the average CRC is about 75%.

However, this number varies greatly depending on the industry. For example, media companies do well, with retention rates hitting 84%. In contrast, the hospitality industry struggles more, with only about 55% of customers sticking around.

This difference makes sense when you consider the nature of these industries.

Media companies, for example, often provide subscription-based services or continuous content to keep customers coming back regularly.

Meanwhile, hospitality businesses—like hotels and restaurants—might only see customers during special occasions or vacations, making it harder to maintain a long-term relationship.

Impact of customer satisfaction on customer retention

- 80% of Americans are in loyalty programs—and it boosts repeat purchases by 60%

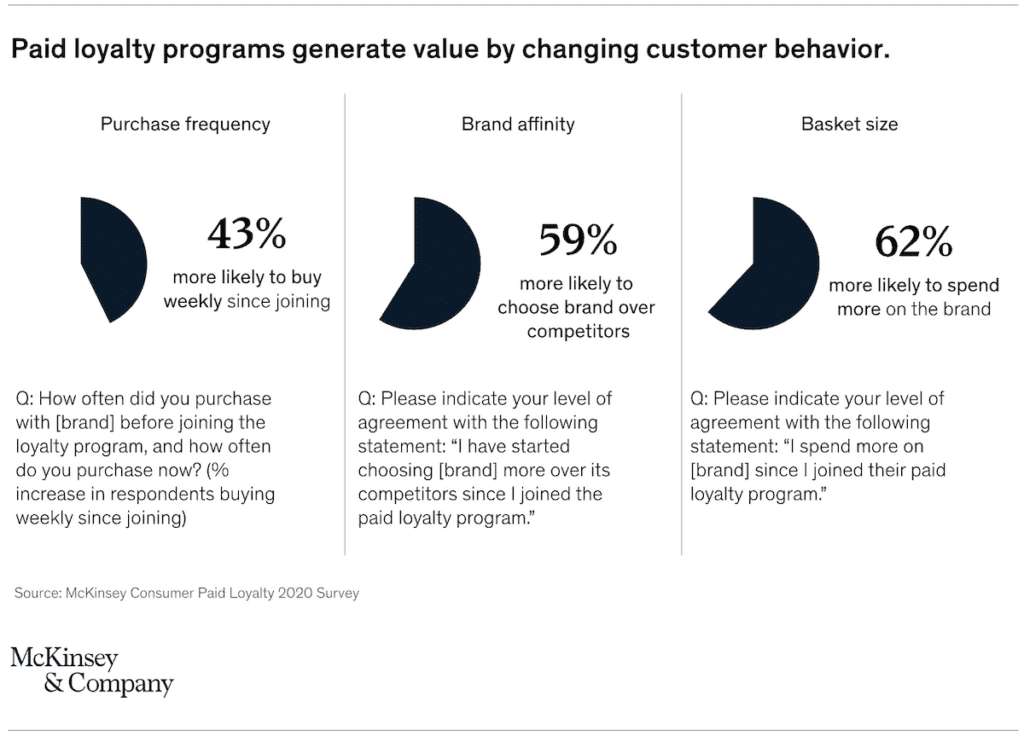

Recent trends show that businesses are focusing more on personalized marketing strategies and loyalty programs to keep customers coming back. And it’s working.

Around 80% of Americans are part of at least one loyalty program, and being in these programs increases the chances of repeat purchases by 60%.

Loyalty programs are all about rewarding customers for sticking around. Whether it’s through points, discounts, or special perks, these programs make customers feel valued and give them a reason to choose your brand over competitors.

This trend also reflects the industry-wide shift toward focusing on retention rather than always chasing new customers. After all, it’s much easier (and cheaper) to sell to someone who’s already bought from you before than to win over a brand-new customer.

- Positive customer experiences lead to 140% more spending

A study found that when customers have a positive experience with a brand, they end up spending 140% more over time compared to those who have a negative experience. (Source)

Think about it—when you feel valued and enjoy great service, you’re more likely to come back, right? Happy customers are also more likely to recommend your business to others, turning into loyal advocates.

The Cost Comparison: Acquisition vs. Retention

Statistical comparison: cost of acquiring vs. retaining customers

- Retaining customers is cheaper than acquiring new ones

According to Harvard Business Review, acquiring a new customer can cost 5 to 25 times more than keeping an existing customer.

Think about that for a second. You spend all this time and money trying to win over new customers through ads, promotions, and outreach but often overlook the people who’ve already bought from you. These people already know and trust your brand—so why not focus on keeping them happy?

Retention isn’t just cost-effective—it also builds loyalty. Customers who stick around tend to spend more over time, recommend you to others, and require fewer resources to maintain.

If you can invest in great service, personalized experiences, and loyalty perks, you’ll save on marketing costs while still boosting your bottom line.

Why is Retention often more cost-effective?

Retaining existing customers is often more cost-effective than it is to acquire customers for a simple reason: the customers you already have know your brand, trust your products, and are much easier to convince to purchase again.

Here’s why focusing on retention can save your business money and drive profits:

- Lower marketing costs: You have already marketed to your existing customers by investing in advertising, lead generation, and sales processes. These measures were important to grab their attention, build trust, and nurture them before they make a purchase. With existing customers, that trust and familiarity are already there, so you don’t need to spend as much on marketing. Instead, a well-timed email, loyalty program, or discount can be enough to get them to buy again.

- Higher customer lifetime value (CLV): Customers who stick with your brand tend to spend more over time. They’re not just making one purchase—they’re coming back for more. This increases their lifetime value to your business, meaning each repeat sale costs less to generate than the first.

- Referrals and word of mouth: Loyal customers are your best advocates. They’re more likely to tell their friends and family about your business, bringing in new customers without you having to spend extra on advertising. Referrals are one of the most cost-effective ways to acquire new customers, and they come naturally from happy, retained customers.

- Reduced sales effort: Selling to someone who’s already had a positive experience with your product or service is easier than selling to someone who’s unfamiliar with your brand. Existing customers are more likely to purchase faster and with fewer objections because they trust you. This lowers your sales costs, and you can now use your existing resources in other areas of your business.

Conclusion: The Balance Between Acquisition and Retention

Businesses now need to find a way to strike a balance between customer acquisition and retention to thrive. While attracting new customers is essential for growth, if you retain customers you already have, your business strategy is likely to be cost-effective and profitable in the long run.

Focusing on customer retention not only lowers marketing and sales costs but also builds loyalty, increases customer lifetime value, and generates organic referrals.

By investing in personalized experiences, loyalty programs, and excellent customer service, you can create a strong foundation for long-term success. Ultimately, businesses that prioritize retention alongside acquisition will see stronger profits, improved customer relationships, and sustainable growth over time.

How Marketers Are Using Online Channels For Retention Or Acquisition

| Online Marketing Channel | Acquisition | Retention | Both Equally |

| Paid search | 86% | 2% | 13% |

| Online display advertising | 85% | 4% | 11% |

| SEO (natural search) | 66% | 6% | 28% |

| Web retargeting | 61% | 22% | 18% |

| Mobile web | 52% | 18% | 30% |

| Mobile and web push notification | 34% | 39% | 27% |

| Social media marketing | 31% | 28% | 41% |

| Mobile apps | 30% | 44% | 26% |

| Website | 29% | 16% | 55% |

| Mobile messaging | 23% | 58% | 19% |

| 21% | 52% | 27% |

Most Effective Digital Marketing Tactics For Customer Retention

| Channel | %age |

| Email marketing | 56% |

| Social media marketing | 37% |

| Content marketing | 32% |

| Referral marketing | 26% |

| Search engine optimization | 13% |

| Display advertising | 12% |

| Mobile advertising | 8% |

| Digital video advertising | 7% |

| Affiliate marketing | 6% |

| Paid search | 4% |