Measuring and managing performance will always help you sort your resources efficiently, accelerate effort in areas where you are lacking, and invest more in areas where you are growing. Once you have a clear sight of where you stand, you get a better picture of where you need to get next.

But monitoring performance and growth is easier said than done. It always helps businesses to benchmark performance based on industry business cycle. If on an average in the industry it takes 2 days for closing a sale and you are able to make a sale in 4 days, then it means you are lagging behind. Either you are targeting the wrong customers or your strategies are not strong. In SaaS, benchmarking the number of days it takes for a visitor to sign-up or subscribes post his first visit, holds the key to understanding how well your website is optimized. If the average time it takes a user to convert is 2 weeks in the industry and your visitors are taking close to a month, it means you need to optimize for subscriptions.

As per McKinsey, a 20% annual growth means a 92 percent chance of ceasing to exist within a few years. You have to scale very rapidly or you will fail indefinitely. How can SaaS companies identify and measure whether they are scaling at this pace? Metrics help them stay on track.

At the end of this article, you will be able to identify 24 metrics that SaaS companies use for measuring and managing performance. A thorough understanding of these metrics will help you stay proactive to plan and achieve targets better.

SaaS Metrics And KPIs that matter – Here’s what you should be tracking

Whether you are a just in business SaaS company or have been around for quite a while now, there are certain key metrics that you would always need to track and measure.

“Your job is to figure out what’s most important right now. What’s on fire? What’s most important for getting the company to its next milestone? Lean into what’s working well and then simplify and clarify the few goals and metrics that your entire company should align on.”

Your growth, from the perspective of, money, sales, and customer retention, is based heavily on how you perform on the following metrics:

1.Unique visits, organic/paid traffic, and active users

Defining unique visits: In simple words, monthly unique visitors is the number of unique visits your websites gets every month.

Measuring the metric: Google analytics will easily tell your monthly unique visitors on its audience analytics section. If one visitor visits your website even multiple times in a month but uses the same device each time to do so, it will be counted as one unique visitor.

Why measure this metric: This metric is that shows you how well you are able to grow your traffic on your website. Every business needs new, unique visitors to grow their product’s reach. How much can you grow from repeat visits? You will need to grow unique views month on month to keep growing in the market.

Growing monthly unique visits: Having a content marketing strategy in place is of great help in growing unique visits month on month. One action tip is to leverage ‘Facebook Lookalike Traffic’. This feature allows you to target new users based on your current audience type. Here is how GrowthText drove 10000+ unique visits in just 30 days, using Facebook lookalike feature and some other tactics.

2.Organic/ Paid traffic

Defining traffic source: Organic traffic is the visitors that find and visit your website through search engines such as Google or Bing. This is traffic acquired through unpaid channels. Paid traffic, on the other hand, refers to traffic acquired through paid sources and channels – PPC, social media ads, sponsored content etc.

Measuring the metric: All you need to do is log in to your Google Analytics. It also makes sense to segment your audience data by type – new, returning, recurring etc.

Why measure this metric: A clear insight into how your users are finding you will enable you to optimize your traffic acquisition strategy. If you are, for example, investing too much in PPC and getting little traffic from this paid source, you can cut down on expenditure from here. On the other hand, if organic traffic is growing on your website, you can focus more on keeping content evergreen to keep the hits coming.

Growing organic traffic: Strong keyword research, internal and external linking, evergreen content – these are just a few ways of getting more organic traffic to your website. Working as per Google’s most recent regulations on SEO is the key to remaining at the top of a search. Consider both long and short keyword searches that users look for on the internet. Guest posting is also important.

Growing paid traffic: From Instagram ads to Linkedin campaigns, you can generate paid traffic from as many channels as you want. What you need to focus on though it what is giving you the best return on investment.

3.Active Users

Defining active users: From a business operations’ perspective, active users is an important metric to measure. To define, active users are the ones who have interacted with your users during a specific time duration. Here, the time duration is an important aspect.

Measuring the metric: Consider an example: An active user of Facebook would be someone who visited Facebook and took an action – logged in or liked an activity update. If for 30 days time duration the user doesn’t log in and perform such interactions, they are considered to be inactive users. This is how you find active vs. inactive users.

Why measure this metric: Active users are a mark of effective engagement and measure of potential sales. If users are interacting with your website – visiting it, buying from you, reading your content, logging into the dashboard of your product – it means they are still content with your services or product.

Growing active users: One way of growing active users is to bring the inactive users back to browsing. Let us consider an example of a SaaS product user who goes inactive after signing up for a free trial. You could send reminder emails to users who signed up for your free trial but did not log in to their dashboard for 2 weeks. You could send them an email saying – ‘You haven’t checked out your dashboard yet. Free trial ends in 3 weeks. Start making the most of your free trial today!’

Growth Metrics:

4.Customer Acquisition Cost

Defining customer acquisition cost: This is the cost that goes into convincing and converting a user to a paying user.

Measuring the metric: To accurately measure CAC, segment it into sales and marketing costs will give you a deeper understanding of customer acquisition channels – PPC, paid ads, sponsored content etc.

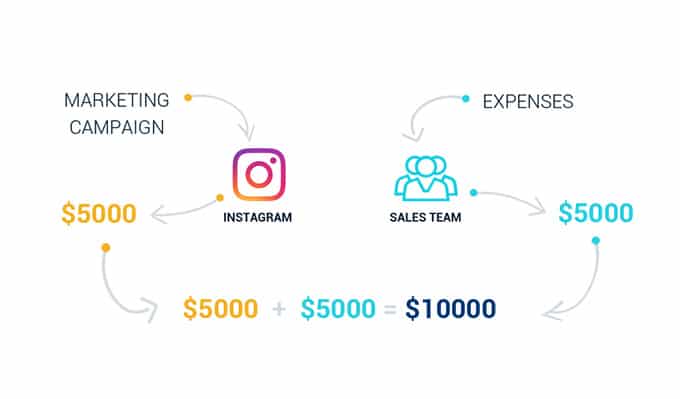

Let us consider an example to calculate CAC. You run a marketing campaign on Instagram that costs you $5000. Expenses from sales team during that month also account for $5000. Total 10 customers are acquired that month from both marketing and sales efforts. Your CAC would calculate to ($5000 + $5000) / 10, which comes out to be $1000 per customer. Why is it important: SaaS companies pay a lot of attention to this one metric – customer acquisition cost. The reason is that it determines the amount that they need to shell out in order to acquire one new customer. Every business needs to understand CAC so that they can wisely invest and scale. Once you know how much you have to spend, you get an idea of how much you have to earn in order to sustain and grow.

Why is it important: SaaS companies pay a lot of attention to this one metric – customer acquisition cost. The reason is that it determines the amount that they need to shell out in order to acquire one new customer. Every business needs to understand CAC so that they can wisely invest and scale. Once you know how much you have to spend, you get an idea of how much you have to earn in order to sustain and grow.

Reducing customer acquisition cost: Aim for more referrals. If you are able to generate enough trust and goodwill from your current set of users, they will refer others to try your product out. This way, you will be required to spend less on advertisements or other paid means for acquiring customers. One tactic is to give extended subscriptions to users who get you a referral. There are a number of more ways to reduce CAC, which you can read here.

5.Customer Lifetime Value

Defining CLV: Over and above the concept of CAC is that of Customer Lifetime Value (CLTV), also known as Lifetime Value (LTV). As per definition, CLTV is the total revenue generated by a customer over the total duration of their subscription to a SaaS product. The higher the ARPA and the lower their churn, the higher will be their LTV.

Measuring the metric: For example, if the Average Revenue per Account is $2000 and your churn rate is 10%. The LTV you are generating is $2000. (explain)

Why is it important: This metric gives you two critical insights:

- How much value is each customer generating

- For how long that customer is generating that value for your business

If you know numbers on both the measures pointed above, you will be able to steer your efforts into retaining those customers who are generating a higher value for a longer duration of time. Clearly, it will help you optimize your retention strategy better. According to Jason Cohen:

“High growth is great, but not if margins are so low there won’t be a profitable business at scale.”

Growing customer lifetime value: There is no short-term tactic to increase customer lifetime value. You must focus on building loyalty for making customers stick to your product. Needless to say, your product and services must be exceptional. Having a unique selling proposition helps in differentiating your product from the rest. Leverage this USP and create an unmatched value for your users.

6.Net Promoter Score

Defining Net promoter score (NPS): NPS rating indicates your company’s performance based on the eyes of the customer. Where all other metrics that we discussed are based on internal benchmarks, NPS tells exactly where you stand as ‘value creator’ in the eyes of your customer.

Measuring the metric: The idea that this metric is based on is all companies can divide their customers into three groups – promoters, passives, and detractors. This division can be done based on a single question – ‘How likely are they to recommend you to a friend?’ Those who score you 9 or 10 on the scale of 0 to 10 are promoters. Those who scale you 8 or 7 are passives. 6 and below are considered detractors.

To calculate the net promoter score, you simply need to subtract detractor percentage from the percentage of promoters. Passives are not taken into account because their response is not clear.

Why is it important: Your net promoter score indicates your product’s ‘likability’. A high percentage of people likely to recommend also predicts that you will need to spend less on acquisition as you might gain new customers from ‘referrals’.

To get more out of your NPS score you need to create a clear set of questions for your customers, asking them for insights. You could ask them the why behind the rating that they have given you on the NPS scale. You could further break-down questions into finding out what users like in your product. This ‘voice of the customer’ or ‘customer feedback’ on your product will pinpoint your product’s strengths and weaknesses.

Improving NPS: Since NPS is all about customer feedback, improving it means you need to incentivize feedback from users. Encourage users to share positive words about your product. If an influencer, for example, is using your product, request him to post an expert review on his blog and share the word on social media.

7.Quick Ratio

Defining quick ratio: It is useful for measuring the efficiency of Saas company.

Measuring the metric: It measured by this calculation: (new MRR plus expansion MRR) divided by contraction MRR plus churned MRR).

Why is it important: It gives you a good insight into the financial performance of Saas company.

Growing quick ratio: It is very important to increase the ratio because the higher it is, the stronger the business will be. Simply put: you increase Quick ratio when you increase expansion MRR (via encouraging upgrades for example), whilst, at the same time decrease churned MRR (via avoiding cancellation for example).

8.Payback Period

Defining payback period: It is the period that a company can recover its investment either above or reach the break-even point.

Measuring the metric: Consider the following example: If company A invests $500,000 and is projected to make $250,000 the first year and $350,000 the second year, the payback period will be around 1.5 years time frame.

Why is it important: It gives an initial impression of the amount the risk that the company may be facing.

Growing payback period: The shorter payback period, the more positive that the company will become cashflow positive. It should be planned well to recover the investment as fast as possible to start gain revenue.

9.CAC:LTV Ratio

Defining CAC:LTV ratio: It is the ratio of customer acquisition cost to customer lifetime value that we have defined already below.

Measuring the metric: It calculated by multiplying the average monthly revenue per customer by customer lifetime measured by months.

Why is it important: It helps us to know how much a company must spend in order to gain a new customer. When the number of the ratio is low for example, (1 to 3) it means that a good target for a SaaS company.

Growing CAC:LTV ratio: By figuring out different methods to gain customers and optimize ad spend and upfront costs to acquire them, you can lower the cost of acquisition. However, the key is not to acquire customers whose lifetime value is worthless.

For example, a client of ours offered a 40% off for first-time buyers for the first month of subscription. This lowered acquisition costs, initially, but the lifetime value of these customers was 1 month. They signed up once for the discount, then canceled. In this scenario, a 40% discount only acquired customers who were not loyal to the brand, but rather the % off.

Revenue Metrics:

10.Monthly Recurring Revenue

Defining MRR: In simple terms, monthly recurring revenue (MMR) can be said to be the income that businesses are certain of receiving every month.

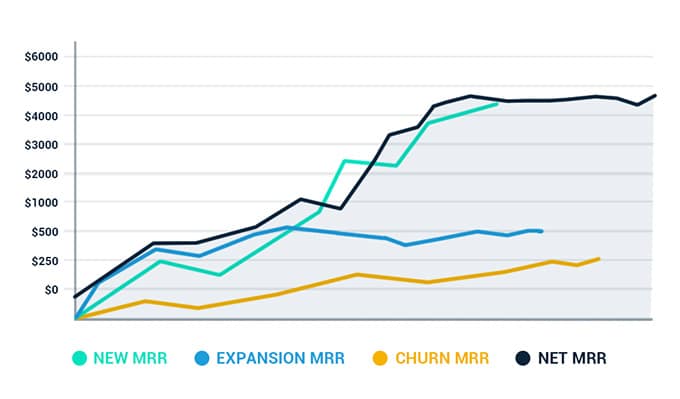

Measuring the metric: To calculate MMR, you need to multiply the total number of paying users by the average revenue earned per user. To check your performance on this metric, you need to break it down into three sub-metrics – New MRR, Expansion MRR, and Churn MRR.

- New MRR: It is the revenue brought in by new customers, on a per month basis. So, if you acquired 5 customers who bring in a total revenue of $500 each per month and 2 customers who bring in revenue of $1000 each per month. Your new MRR would be $4500 per month.

- Expansion MRR: This is revenue earned when a customer upgrades to a higher priced plan. For example, two customers are using a $400 per month ‘basic’ subscription of your product upgrades to $650 ‘premium’ plan. Your expansion MRR, in this case, would be $500 per month.

- Churn MRR: The opposite of expansion MRR is churn MRR. It is the revenue lost when a customer either cancels a plan or downgrades to a lesser priced plan. So, if someone downgrades to $400 plan from $650 plan, your churn MRR would be $250 per month.

Why is it important: The higher your predictable income or revenue, the better your chances of being in operation. Therefore, MRR should continuously be growing.

Growing MRR: There are a number of smart tactics that can help you increase your monthly recurring revenue. For example, you could unbundle the features of your product, offer a yearly pre-payment, or go enterprise and sell to big businesses that are likely to pay more.

11.Annual Run Rate

Defining ARR: It is the same term of monthly recurring revenue (MMR), but the income that businesses are certain of receiving every year rather than every month.

Measuring the metric: It is calculated by multiplying MMR by 12 (months) which results to the income of the whole year.

Why is it important: ARR helps businesses to predict annual earnings and revenues for the next years by assuming that no changes occurred in the year. In short, It can be used for long-term growth because it depends on annual reports.

Growing ARR: Improving ARR is a very helpful indicator that your business is working well. As increasing monthly recurring revenue (MMR), it is automatically will make an increase in ARR.

12.Average Sale Price

Defining ASP: It is the average price which customers initially pay to subscribe.

Measuring the metric: To calculate ASP, you should define all your subscription revenue and then divide it by the number of subscriptions.

Why is it important: Understanding this metric allows you to determine the right sales model for your SaaS company. A low ASP means a self-service or low-service sales model, on the other hand, a high ASP enables you high-oriented sales strategies.

Improving ASP: Increasing ASP is not easy and requires extra effort. This is at the essence of CRO: understand the target customers, collect demographic information and then brainstorm ideas for marketing campaigns to decide how to improve your service and increase ASP at the same time.

13.Average Revenue per Account

Defining average revenue per account: ARPA is a measure of revenue contributed by an “average” account or customer, on a month-by-month basis.

Measuring the metric: You can arrive at average revenue per account by dividing monthly recurring revenue by a number of active accounts per month. ARA can be calculated for both existing and new customers. You should calculate ARA separately for both sets of customers if you are planning on changing your pricing, or want to dig deeper into how existing vs. new customers are contributing to your revenue.

Why is it important: ARPA will give you a clear picture of how your groups of accounts are performing on a monthly basis, is there a need to change pricing for any specific cohort, and an overall picture of how your ARPA is evolving.

Growing your ARPA: Upselling and cross-selling are two very famous tactics to improve ARPA, in both SaaS and eCommerce. You could, for example, upsell to those subscribers who have been using your product for over 2 years.

14.Support Tickets Raised

Defining Support Tickets Raised: This is simply the number of people who need help and are requesting their problems be addressed.

You may need to fix the product usability in this case or increase the number of customer support service providers when the heavy volume of tickets are raised or are expected.

Measuring the metric: Looking at your customer support data will give you an insight into this metric.

Why is it important: This metric needs to be tracked and measured to analyze the support team’s performance and to find out if your customers are satisfied with your service.

An increase in the number of support tickets points out that higher number of people are finding it difficult to use your product. A decline in the number of support tickets in itself does not imply anything. It could mean anything – customers not using the product and hence not having any problems, customers being able to understand the product’s functioning on its own, and so on. You can figure this out depending on usage and so forth.

Improving on this metric: You need to continuously work towards making the product as user-friendly as possible. Onboarding needs to be super easy, and so does every other feature in your product.

Customer Success Metrics:

15.Conversion Rate

Defining conversion rate or free trial conversion rate: It is the number of people who started with a free trial and actually converted to paying customers.

Measuring the metric: Analyze the following steps to know your performance on free trial conversion rate:

Visited Site ==> Trial Sign-Up ==> Activation ==> Logged-In ==> Billed

But is there a benchmark for ‘free to paid conversions’ that companies should follow? No. You simply need to keep growing in this area. So, today if 2% of free trials convert to paying customers, you should aim at increasing this to 5%, and so on.

Why is it important: It is important to measure conversion rates to track web page and app performance. Knowing how many users are completing the desired micro and macro goals on your website will help you understand whether your product is optimized properly. You can dig deeper into finding out how your users use your product, what encourages them to complete the desired action, and what are the bottlenecks. Doing so will help in improving overall product functioning and optimizing the funnel for increased conversions.

Improving conversion rate: To improve conversion rate of your SAAS website you must have clearly defined goals in place. For example, is your goal to increase the conversion rate for a certain set of audience such as high-value customers? Then you might need to optimize in a way that such customers convert faster and better. It could also result in the conversion rate of average paying customers dropping. It all depends on your conversion optimization strategy and what goals are you planning on achieving. Also, your onboarding should be really smooth and customer support be really strong, for converting customers in their free trial period into paying customers.

16.Churn Rate

Defining churn rate: Without understanding and measuring churn rate, you cannot understand LTV. In terms of customers, churn rate measures how many customers were lost during a given time period. You could also define it as the number of customers who unsubscribed to your product in a given period of time.

Measuring the metric: Churn rate is a comparative metric. It shows you the month on month churn or loss of users. To calculate churn rate, you need to divide the number of customers who unsubscribed to your product in a month by the prior month’s total.

Why is it important: A high customer churn rate is indicative of the fact that either your customers are not getting the desired value out of your product anymore, or that you don’t have a good customer support and retention team in place. Customers not sticking around too long means they have found someone better or will soon find someone who serves their needs better. It implies increased costs of acquiring new customers. According to Huw Slater:

“Not to be mistaken for the rate at which your customers can turn cream into butter, your Customer Churn Rate tells you how quickly your customers cancel their subscription”

Reducing churn rate: Even though a user has signed-up does not mean he is likely to keep using your product for a long time. To ensure that the customer doesn’t churn, at appropriate intervals, keep sending trigger-based emails that nudge the user to log-in to the dashboard and stay active. It is also important, to provide quality customer service, for keeping customers satisfied with your support quality.

17.Customer Retention Rate

Defining customer retention rate:

Measuring customer retention rate: Let’s understand customer retention rate with the help of an example. At the start of the month, you have 100 customers. By the end of the month, the number of customers you have is 105. During this time period, you have acquired 20 new customers and lost 15. Your customer retention rate would be:

{(Number of at end of the time period – Number of new customers acquired during that period divided)/Number of customers you had at the start of that period} x 100

Which is {(105-20)/100} x 100

The resulting percentage is 85%. What this means is that 85% of your customers continued using your services for that time period. This is a good customer retention rate.

Why is it important: This metric indicates how good your customer retention efforts are and how loyal is your user base. A growth in this metric indicates that your retention efforts are paying off and that you are likely to earn more from existing user base. According to Hunter Witherington:

“Retention is not simply a financial metric. In addition to the pure financial benefits of having strong customer/revenue retention which drives revenue growth, retention metrics and the underlying data needed to calculate them can inform critical business decisions and drive business strategy.”

Improving customer retention rate: Rewarding loyalty, providing great customer service, resolving problems quickly, building ‘habit-forming’ products – these are just some of the many ways for improving customer retention. Your retention optimization strategy, should be your go-to guide for increasing customer retention rate.

According to David Skok:

“Focus more of your retention energies on the onboarding phase, rather than on saving deals later. Make sure your onboarding process, people, and materials are excellent.”

18.MRR Retention Rate

Defining MRR retention rate: It refers when the rate monthly recurring revenue (MMR) is renewed.

Measuring the metric: It measured by dividing MRR of renewed subscriptions by the total of MRR of subscriptions up for renewal.

Why is it important: It is necessary to know how to encourage customers to renew their subscription. By understanding how many customers renew, and thus the drop-off rate, you can have a clearer picture of what needs to be done.

Improving MRR retention rate: There are some strategies that can leverage MRR retention rate such as make incentives and loyalty programs which keep customers engaged, and in communication with you somehow.

19.Marketing Qualified Leads/Product Qualified Leads

Defining MQLs and PQLs: A prospect who has already entered your lead tracking, meets certain criteria to qualify as a potential customer, and has expressed interest in buying is a qualified lead. When marketing qualifies such lead using branding, online advertising etc. it is called an MQL. In SaaS, apart from MQL, the concept of product qualified leads is also gaining strength.

Measuring the metric: A look at your Hubspot report or into a platform such as Salesforce will give you a clear picture of your MQLs. However, what really helps is understanding whether you have been able to generate quality MQLs. Track whether the MQLs fit your ideal customer persona. This will give a more holistic picture of your MQLs.

Why measure the metric: PQLs can be seen as potential customers who have used a product and have accomplished certain predefined triggers that show a high probability of these ‘potential users’ to convert into paying customers. The definition of PQLs itself highlights the importance of keeping a track of this metric. Focusing on PQLs can help you channel your effort and resources in changing ‘likelihood’ into ‘assurity’ that the potential user will convert. Another important reason why PQL must be a metric of performance for every SaaS company is that it ties all departments together to achieve one goal – revenue.

According to Jacco Van Der Kooij:

“Reactionary to an inbound request (MQL) from a customer who experiences a pain, such as a demo request, trial sign-up, pricing request. The client is often interested to resolve it asap making this very time sensitive requiring a response in <5 minutes.”

Growing MQLs and PQLs: Increasing MQLs requires your marketing team to make more efforts in terms of lead nurturing, content marketing, and refining the funnel. Increasing PQLs would require you to actually understand what those users who are actually using your product, really like about it. Make those changes that the user has suggested. Value the voice-of-customer and see PQLs increase.

20.Lead Velocity Rate

Defining lead velocity rate: This metric compares the number of leads generated this month with those generated in the previous month. These leads are qualified.

Measuring the metric: The formula for measuring this metric is as follows:

{(Qualified leads in current month-Qualified leads in the previous month)/ Qualified leads in the previous month} x 100

Why is it important: Measuring qualified leads is one thing, but are you taking into account the monthly growth in qualified leads? You don’t want your qualified leads to stagnate or diminish month over month. To keep track of how you are doing in this department, you need to calculate and measure your lead velocity rate.

If your leads keep flowing in consistently, month-over-month, and you have a strong sales team to keep converting the potential users into sales, you are likely to achieve revenue goals smoothly. On the other hand, if the leads keep pouring in but the sales aren’t able to convert these into buying customers, you will need to check what’s wrong. Individual and team performance will need to be evaluated here. But the end target would be to get the lead velocity rate spiking and converting leads to revenue-generating customers.

Growing LVR: To boost LVR, you first need to understand what causes it to slow down. One of the reasons is not defining objectives clearly for teams. For example, if your marketing and sales teams are not on the same page regarding how a lead should be handed off, it could result in LVR slowing down. Similarly, standardizing procedures can help sort out any confusion in terms of lead qualification and reporting. Having an integrated system to capture and analyze customer data can help eliminate obstacles that slow LVR down.

21.Average First Response Time

Defining average first response time: It is a measure of how long it takes for your customer support executive or manager to address a customer or to act on a support ticket raised.

Measuring average first response time: If a customer raises a support request at 9 a.m. and received a response by 11 a.m., the first response time would be two hours for that day for that customer.

Why is it important: AFRT is a measure of the first impression that you are leaving on customers who contact you at the time of need. By measuring performance on this metric you are able to identify how efficiently you are able to tackle customer queries. A good first-time response rate means customer satisfaction and is an important indicator of customer retention team’s performance.

Reducing average first response time: Depending on the frequency and amount of first-time queries you receive, you might need to increase your customer support team size. You will also need to make sure that the CS team is well-trained to answer customer queries with quality solutions. Additionally, making your product user-friendly will enable customers to onboard without help.

22.Net MRR Churn Rate

Defining net MRR churn rate: It is the rate at which existing customers make the cancellation of their contract or downgrade their subscription after factoring revenue such as upgrade or expansion from remaining customers.

Measuring the metric: It is calculated by subtracting the total of expansion MRR from MRR churn and divided that number by MRR at the start of the month, then multiply by 100 to get the result in percentage.

Why is it important: It is a good indicator that gives you an insight into your customers and determines which are the negative factors that make customers leave your company or make a cancellation.

Growing net MRR churn rate: To increase the net MRR churn rate, you have to make a continuous improvement that ensures your customers are satisfied. This tip will save your company from any cancellation or downgrade and if it really occurred, it should be correcting and investigate the problem and try learning from mistakes.

Sales Metrics:

23.Average Sales Cycle Length

Defining average sales cycle length: It is the average time of converting leads to the moment of a completed sale. In other words, it is a series from initial contact to sale close.

Measuring the metric: It measured by dividing a number of days from the first contact to the moment of a sale close for all deals by the number of deals.

Why is it important: It is useful for sales forecasting.

Reducing average sales cycle length: It is very important to reduce average sales cycle length it results in faster time gaining paying customers. It’s useful to target each segment separately through various automation in the sales pipeline that monitors customers until they convert.

24.Annual Contract Value

Defining ACV: It is the value of an account subscription of annual customer’s contract.

Measuring the metric: We can calculate ACV by dividing the total value of the contract by the total period.

Why is it important: ACV in order to compare it to customer acquisition cost CAC, in order to decipher further the cost of acquiring a customer for a specific period.

Improving ACV: Cross-selling and upselling are two useful ways to increase annual contract value. Product discounts are also good for attracting customers and close deals faster.

Over to You – What metrics are helping you keep a track on growth?

There are a number of metrics that you can define for tracking growth. The ones that we discussed above, are, however, some of the most important ones. Which ones out of the above are you measuring performance on? Do let us know why those metrics matter to you, in the comments section.