Imagine a chessboard where each move reveals an opportunity or threat. Without studying your opponent’s strategy, you are likely to get outmaneuvered. The same applies in business—competitive analysis is your playbook for success.

By assessing competitors’ strengths, weaknesses, and strategies, you can uncover opportunities, refine your plans, and stay ahead of industry trends.

This article breaks down the essentials of competitive analysis with real-world examples and actionable steps to help you outsmart the competition.

What Exactly is Competitive Analysis?

Competitive analysis involves analyzing your competitors’ successes and losses to identify their strengths, weaknesses, strategies, and market positioning. This helps you identify opportunities, mitigate risks, and make informed decisions to gain a competitive edge.

Think of it as doing homework before playing a high-stakes game—you can’t win if you don’t know your opponent’s moves.

Why is Competitive Analysis so Important?

Imagine running a race without knowing who else is competing, their speed, or their strategies. That’s what it’s like for a business without competitive analysis.

In the early 2010s, Nokia dominated the mobile phone market. Yet, they failed to recognize the shift toward smartphones driven by Apple and Android. Without a solid competitive analysis of these emerging players, Nokia stuck to outdated strategies and missed the touch-screen revolution. The result? A dramatic fall from being a market leader to an industry afterthought.

Here’s a quick overview of why competitive analysis is so integral to a business:

- Understand Market Gaps: Identify untapped opportunities your competitors are missing.

- Refine Your Strategy: Adjust your pricing, marketing, or customer experience based on competitors’ strengths and weaknesses.

- Stay Relevant: Predict industry trends and customer preferences before others do.

How to Conduct a Competitive Analysis

Define goals and objectives

Defining your goals and objectives is the first and most critical step in conducting a competitive analysis. Think of it as creating a map before you start a journey—you need to know where you’re going and why you’re going there.

Without clear goals, your analysis risks becoming a pile of data without direction or purpose.

Here are some types of goals for competitive analysis:

- Understand market position: Where do you stand compared to competitors? What gaps or opportunities exist in your industry?

- Improve customer experience: What do competitors do better? How can you adapt their strengths to meet your customers’ needs?

- Refine marketing strategy: What messaging resonates with your audience? How can you differentiate your branding?

- Identify innovation opportunities: What new features or trends are gaining traction? How can your business stay ahead?

Now that you know the goals you can set for your company, how will you define your goals? Here’s a step-by-step approach to help you determine your goals effectively:

Start with your business objectives. Every competitive analysis should tie back to your company’s larger goals. For example, if your company wants to expand into a new market, your analysis should focus on local competitors and customer behavior. For example, when Starbucks expanded into China, it aimed to understand local tea culture and how competitors catered to it. The competitive analysis helped them integrate tea-based beverages into their menu, establishing a strong presence in a tea-dominated market.

- Identify your target audience. Define whose needs you want to meet. Your goals might focus on understanding why competitors attract a specific customer segment. In fact, a study by Epsilon revealed that 80% of customers are more likely to engage with brands that offer a personalized experience. And knowing your competitors’ audience can help you deliver personalization better.

- Ask key questions. Frame questions in a way that answers shape actionable goals.

- “What do customers love about my competitors?”

- “How do competitors use pricing, promotions, or products to win?”

- Use data-driven insights. Back your goals with data. You can use tools like Google Trends, SEMrush, and social media analytics to get insights into what works for competitors.

Pro tip: Use the SMART framework for goal-setting (Specific, Measurable, Achievable, Relevant, Time-bound). For example, “Increase market share by 10% within six months by targeting Gen Z customers through Instagram ads.”

Gather competitor data, including strengths and weaknesses

When conducting a competitive analysis, the next important step is to gather accurate, actionable data about your competitors. This data helps you identify their strengths, weaknesses, and ways you can differentiate yourself from them.

Here’s how to do it effectively:

- Start by defining what data you want to collect. Start by identifying the key aspects of your competitors you want to analyze. These typically include:

- Market positioning: Where they stand in the industry

- Product or service offerings: Features, quality, and pricing

- Marketing and branding: Channels, tone, and customer reach

- Customer experience: Support, reviews, and engagement

- Use reliable tools for data collection. To gather valuable and actionable competitor data, you’ll need the right tools to save time and provide deeper insights. These tools analyze everything from website traffic to customer engagement, clearly showing how your competitors operate and where they excel or fall short.

- SEMrush or Ahrefs: Analyze competitors’ SEO performance, keywords, and backlinks.

- SimilarWeb: Understand their website traffic, audience demographics, and referral sources.

- Sprout Social or Brandwatch: Monitor their social media strategies and audience engagement.

- Glassdoor or Indeed: Learn about internal strengths and weaknesses through employee reviews.

- Gather qualitative data. In addition to using tools, you need qualitative methods to gain deeper insights into what competitors are doing and how customers feel about them. These methods focus on understanding the why behind the data and provide actionable details that numbers alone can’t offer. Here’s how you can do it:

- Competitor websites and reports: Look for annual reports, press releases, and blog content. Use these reports to determine their pricing details, product features, and unique selling points. Their blog content, whitepapers, and press releases will help you understand their brand’s messaging and priorities.

- Customer reviews and forums: Use Yelp or Reddit to uncover customer sentiments about competitors.

- Mystery shopping: It involves experiencing the products or services firsthand.

- Apply a framework to analyze strengths and weaknesses. To break down data, use a framework like SWOT (Strengths, Weaknesses, Opportunities, Threats) framework to break down data.

- Strengths: Look for their competitive edges, like superior technology or loyal customer bases.

- Weaknesses: Identify gaps such as high prices or limited product diversity.

Companies that fail to identify their weaknesses and those of their competitors often lose the market to a new contender. One of the most prominent examples is when Kodak failed to recognize its weakness—reluctance to embrace digital photography—and lost its competitive edge to companies like Sony and Canon.

- Combine insights from multiple sources. Cross-reference findings from tools and methods to build a holistic picture. For example:

- If SEMrush shows high traffic for a competitor’s blog, use social media tools to check how they promote it.

- If customer reviews indicate poor service, check Glassdoor for potential internal issues.

Pro tip: Competitors evolve constantly, so don’t forget to update your data regularly to stay informed—for instance, track product launches, partnerships, or rebranding efforts. You can also set up Google Alerts or subscribe to competitor newsletters to keep yourself updated.

Evaluate key metrics

The next step is to evaluate key metrics—which involves analyzing measurable data points that reveal your competitors’ strengths, weaknesses, and market performance.

Tangible metrics will show you where your business stands compared to others and what to improve or focus on to succeed in the market.

Start by understanding the key metrics to evaluate:

To get a complete picture, focus on these critical areas:

- Market share and reach: How much of the market do competitors control?

- Customer sentiment and engagement: What do customers say about their products and services?

- Product or service quality: Are their offerings superior or lagging?

- Pricing strategies: Are they underpricing, premium pricing, or bundling effectively?

- Operational efficiency: How quickly do they deliver, and what’s their supply chain like?

For example, Tesla disrupted the automobile market by evaluating its competitors’ reliance on internal combustion engines. Focusing on electric vehicles and assessing gaps in innovation, the company managed to carve out a dominant niche.

Leverage metrics to measure marketing effectiveness:

Use marketing metrics to see how competitors connect with their audience.

Here’s a list of metrics and elements to consider:

- Website traffic and SEO performance: Use tools like Google Analytics and SEMrush to reveal traffic volume, top-performing keywords, and backlinks.

- Social media engagement: Leverage tools like Sprout Social to determine likes, shares, comments, and audience demographics.

- Content marketing impact: Look at the frequency of blogs and videos and how they resonate with the audience.

Evaluate financial metrics:

Assessing competitors’ financial performance is essential to see whether their efforts are paying off. Financial metrics will give you a clear picture of their stability and growth.

Key metrics include:

- Revenue growth: Indicates market demand and business health.

- Profit margins: Reflects operational efficiency.

- Investment trends: Look at R&D spending or acquisitions to gauge innovation.

Track industry-specific metrics:

Depending on your industry, metrics may vary. Examples include:

- Churn rate: It’s especially critical in SaaS to measure how many customers cancel their subscriptions.

- Foot traffic: Important for retail and hospitality businesses.

- App downloads and ratings: Crucial for tech and mobile-first businesses.

For instance, Netflix tracks user churn to understand when and why subscribers leave. It uses this insight to adjust pricing, add new features, and prioritize trending content, keeping churn at competitive levels.

Finally, use collected data to compare competitors’ metrics against your own performance.

You can do this by identifying areas where you excel, and double down on those strengths. Secondly, spot gaps where competitors are ahead, and develop strategies to close them.

Create actionable strategies

Once you’ve gathered data and evaluated key metrics, the next step in a competitive analysis is to use your uncovered insights than turn them into actionable strategies.

This ensures your findings drive tangible changes to improve your position in the market and get an edge over the competition.

Your first step is to align findings with your business objectives. Ask yourself:

- What gaps can we exploit in the market?

- Where can we differentiate our offerings?

- How can we strengthen our weaknesses against competitors?

Once you have an answer to these questions, it’s time to develop strategies to get a competitive edge.

Your strategies can fall into two categories:

Offensive Strategies: Playing to Your Strengths

Offensive strategies are about staying ahead of your competitors by using your strengths or targeting areas they’re missing. They involve focusing on:

- Building on your strengths: Use what you do best to create an advantage.

- Filling market gaps: Look for unmet customer needs or underserved groups and step in.

- Innovating boldly: Introduce unique products or features competitors don’t offer.

For example, Airbnb expanded globally by addressing gaps in affordable and unique accommodations. Instead of competing directly with hotels, it targeted travelers seeking home-like stays or unconventional options, like treehouses or houseboats.

Defensive Strategies: Protecting What’s Yours

Defensive strategies are about holding onto what you already have—your customers, market share, and position. The goal is to address any weaknesses and prevent competitors from taking over your space.

It involves focusing on:

- Improving customer experience: Look at where competitors excel (e.g., faster delivery, better support) and close the gap.

- Matching competitive pricing and promotions: Keep an eye on competitor pricing—if they lower prices or run promotions, respond quickly. Offer added value like loyalty rewards or free shipping to stay ahead.

- Strengthening brand loyalty: Reward loyal customers with exclusive perks, early access, or personalized offers. Create emotional connections through strong branding and consistent messaging.

- Enhancing product and service quality: Focus on fixing weaknesses competitors could exploit. Improve durability, ease of use, or features in your offerings

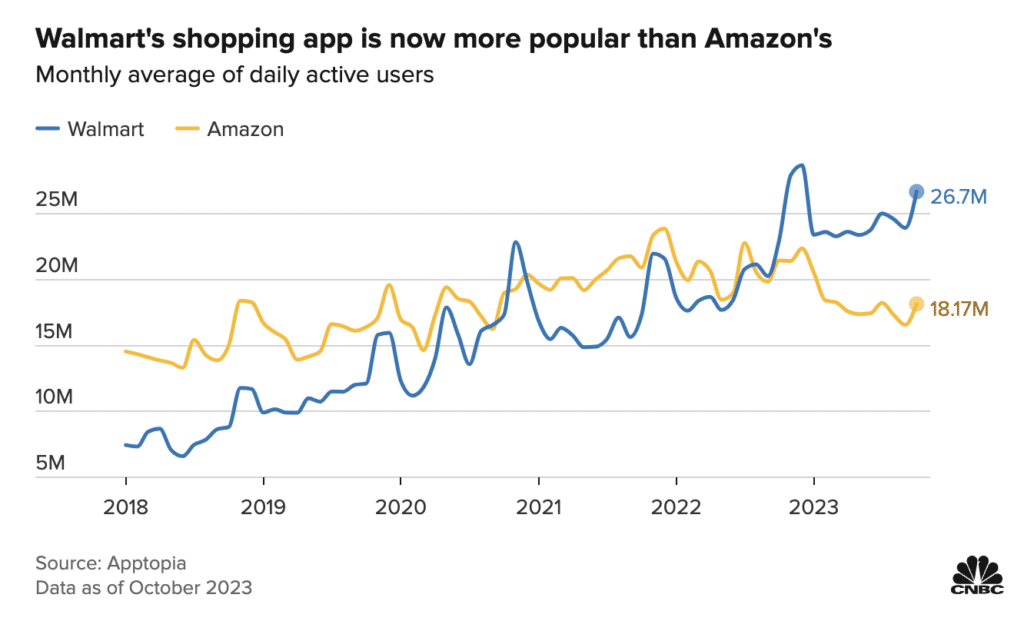

One of the biggest examples of defensive strategy in the competitive market is between Walmart and Amazon.

When Walmart noticed Amazon’s dominance in convenience and delivery, it overhauled its e-commerce platform, launched same-day delivery services, and introduced grocery pickup options.

The result? Walmart’s shopping app is now more popular in the US than even Amazon’s app. Addressing these operational gaps helped Walmart maintain its position as a major retail force.

Your Turn to Gain an Edge Using Competitive Analysis!

Competitive analysis is a powerful tool to stay ahead in business. By studying your competitors, you can spot opportunities, fix weaknesses, and improve your strategies. This helps you stay relevant, offer better experiences, and outsmart the competition.

Use the steps in this article to guide your analysis. By understanding what your competitors are doing, you can make smarter decisions and keep moving forward. Competitive analysis isn’t just about keeping up—it’s about leading the way. Stay proactive, and let this strategy help you win.

Competitive Analysis FAQs

What is a Competitive Analysis?

A competitive analysis is a deep dive into your competitors—who they are, what they offer, their strengths, weaknesses, and how you compare. It helps you spot opportunities and gaps in the market.

How do I a Competitive Analysis?

Identify your key competitors, analyze their products, pricing, marketing, and customer experience. Look at their strengths, weaknesses, and what sets them apart. Use this data to refine your own strategy.

What is Included in a Competitive Analysis?

It covers competitor offerings, pricing, positioning, marketing strategies, customer reviews, strengths, weaknesses, and areas where you can stand out.

How to Present a Competitive Analysis?

Keep it clear and actionable. Use tables, charts, and summaries to highlight key insights. Focus on what matters—where you can win and what threats to watch.

Why do a Competitive Analysis?

It helps you understand the market, stay ahead of competitors, and make smarter decisions. Without it, you’re flying blind.